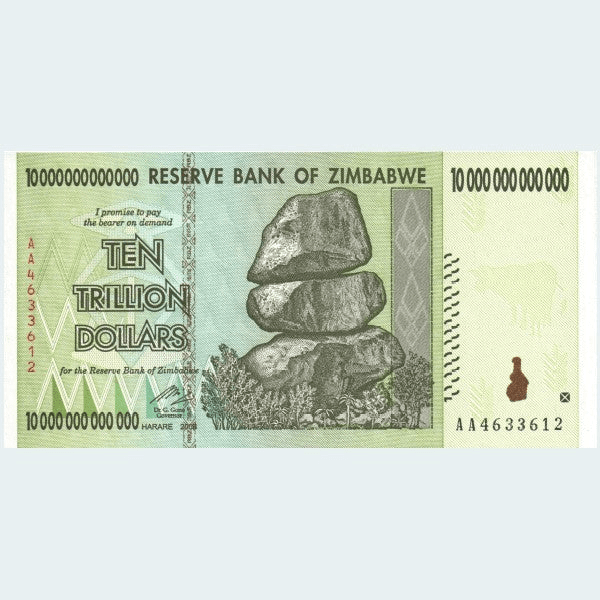

Why are the forecasts for gold prices by bankers so far short of reality? As recently as late March, banks were forecasting a year end price (12/31/25) for gold of $3,100! As of today, gold is $3251! That’s 5% over the already outdated forecast with close to 9 months left in the year! Why are they so off base on their forecasts? It’s easy to print a “0” or two “0’s” or infinite “0’s”! Look at Zimbable several yeas ago and see all of the 0’s! Printing paper is easy and requires minimal work as opposed to digging in the ground for gold, filtering it, smelting it, casting or stamping it and distributing it.

$10,000,000,000,000 (Trillion) note from Zimbabwe

Now, to put this in some perspective for the younger American in particular; my father in 1912, as a boy, could have all the candy he could hold in one hand for one penny. As a kid, I could buy a nice size Snickers candy bar for one nickel. Today, a Snickers bar cost $1.14 at Walmart! The dollar is being devalued at a very rapid rate – high inflation now with hyper-inflation coming.

As an example of how bad hyper-inflation can get; in the Weimar Republic of Germany, a man wento to the store to buy something. He brought a wheel barrow full of money to the store. The door was too narrow to bring the wheel barrow in, so he left it at the front door while he went in to shop and find out how much he owed. Upon finding out how much money he needed, he came back outside to get the money. He found his money there, but it had been dumped on the ground, and his wheel barrow was stolen! In those times, people were burning their money to stay warm, and papering their walls with their money. The bottom line is their money was worthless! Only tangible assets had any value i.e. real estate, tools, crops, food, water, gasoline etc.

So, you can see that the bankers do not want to encourage people to buy gold because it’s going up, because that also means the dollar is going down, and that means their Ponzi scheme is going bust – it’s been discovered! So, the banksters give low forecasts for the gold price in hopes that people will not get too exhuberent about buying it. Especially if it appears that it is not going up in value commensurate with other assets. Keep your money in the stock market, bonds, cash, or whatever represents their best interests which gold and silver do not.

The second and more sublte, but equally devastating, scenario is the derivatives market which in simple terms is a massive gambling casino that the banksters play at. They bet that the price of gold and silver will go up or down, and they will bet on the future of them. When the bet comes due, they must pay up. They put down 10% known as margin, and pay, or collect, as the case may be, the other 90% of the contract on the due date. With gold and silver, they pay people off in dollars and rolled over paper contracts, because they figure nobody will want to take actual possession of the metals.

Uh oh, when that changes and people want possession, they don’t have it and they have to go out and buy it, which drives up the price. So, now you know.

Also you should know two other things. Gold and silver are historically the only legal money in America. In the Bible, gold and silver are mentioned as money as well.

Pensiamento Peligroso

Break The Matrix

Break The Matrix Children's Health Defense

Children's Health Defense Dan Bongino – The Dan Bongino Show

Dan Bongino – The Dan Bongino Show Dr. Dave Janda

Dr. Dave Janda Dr. David Martin

Dr. David Martin For The Love of Freedom

For The Love of Freedom G. Edward Griffin – Need To Know News

G. Edward Griffin – Need To Know News Greg Hunter USA Watchdog

Greg Hunter USA Watchdog Jack Kettler – Underground Notes

Jack Kettler – Underground Notes James Corbett – The Corbett Report

James Corbett – The Corbett Report John Stossel – Fox Business

John Stossel – Fox Business Luke Rudowski – We Are Change

Luke Rudowski – We Are Change McAlavany Commentary

McAlavany Commentary Mercola

Mercola Mike Adams – Natural News

Mike Adams – Natural News Mike Rivero – What Really Happened

Mike Rivero – What Really Happened Paul Cameron – Family Research Institute

Paul Cameron – Family Research Institute Paul Craig Roberts – Institute for Political Economy

Paul Craig Roberts – Institute for Political Economy Paul Joseph Watson

Paul Joseph Watson Peter Schiff – Schiff Radio

Peter Schiff – Schiff Radio Ron Paul – Campaign for Liberty

Ron Paul – Campaign for Liberty Stefan Molyneux – Freedom Radio

Stefan Molyneux – Freedom Radio The New American Magazine

The New American Magazine Thomas Sowell

Thomas Sowell VisualPolitik EN

VisualPolitik EN